The full house passed late wednesday by a 357 to 70 vote h.r. In 2025, the bonus depreciation rate is set to reduce from 80% to 60%.

In 2025, bonus depreciation continues to be a valuable tool for businesses looking to invest in new or used property, offering a deduction of a certain percentage of the asset’s cost.

With the current tax law, if you purchased an aircraft in 2025 (new or used), you would be eligible to deduct 80% of the purchase price of the aircraft in 2025 using.

Section 179 Bonus Depreciation 2025 Tine Adriana, Phase down of special depreciation allowance. Bonus depreciation deduction for 2025 and 2025.

No Bonus Depreciation In 2025 Rhody Cherilyn, In 2025, bonus depreciation continues to be a valuable tool for businesses looking to invest in new or used property, offering a deduction of a certain percentage of the asset’s cost. House of representatives passed hr 7024, the tax relief for american families and workers act of 2025, on wednesday, january 31, 2025.

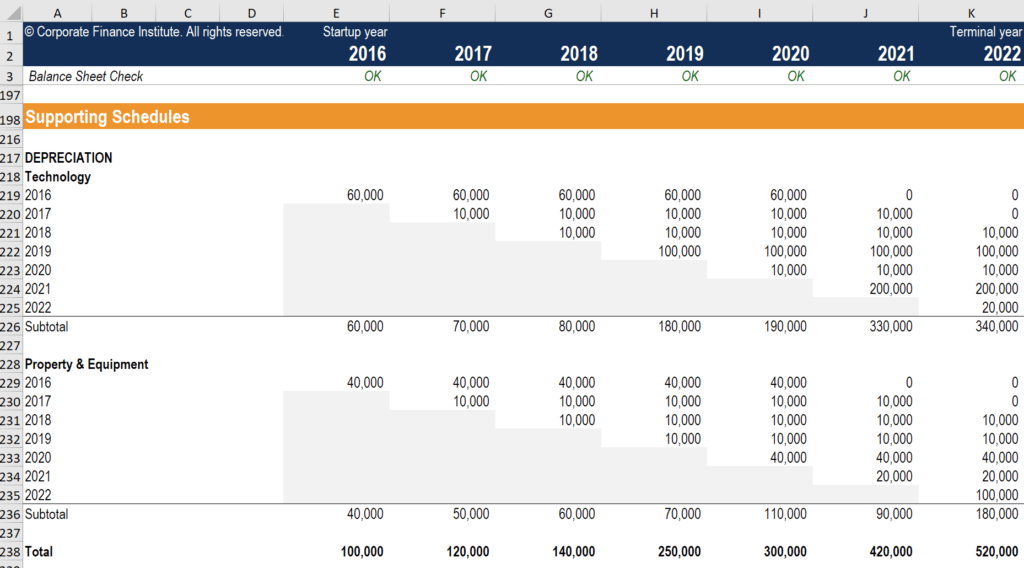

8 ways to calculate depreciation in Excel (2025), Extend 100% bonus depreciation for qualified property placed in service after dec. The full house passed late wednesday by a 357 to 70 vote h.r.

What Is Bonus Depreciation A Small Business Guide, The “tax relief for american families and workers act of 2025” heralds a new chapter in u.s. Extend 100% bonus depreciation for qualified property placed in service after dec.

New Bonus Depreciation Rules for Qualified Improvement Property, The bill delays the beginning of the phaseout of 100% bonus depreciation from 2025 to 2026. Tax legislation, with 100% bonus depreciation standing out as a.

How to Calculate Bonus Depreciation Under the New Tax Law, The new legislation limits the use of bonus depreciation for the following businesses: 31, 2022, and before jan.

Bonus Depreciation vs. Section 179 What's the Difference? (2025), Extension of 100% bonus depreciation. Bonus depreciation deduction for 2025 and 2025.

Bonus Depreciation Calculation Example Ademolajardin, House of representatives passed hr 7024, the tax relief for american families and workers act of 2025, on wednesday, january 31, 2025. 1, 2027, for longer production period.

Understanding Bonus Depreciation WilsonHaag, PLLC, Tax legislation, with 100% bonus depreciation standing out as a. New bipartisan legislation, the tax relief for american families and workers act of 2025, includes 100% bonus depreciation as well as research and development.

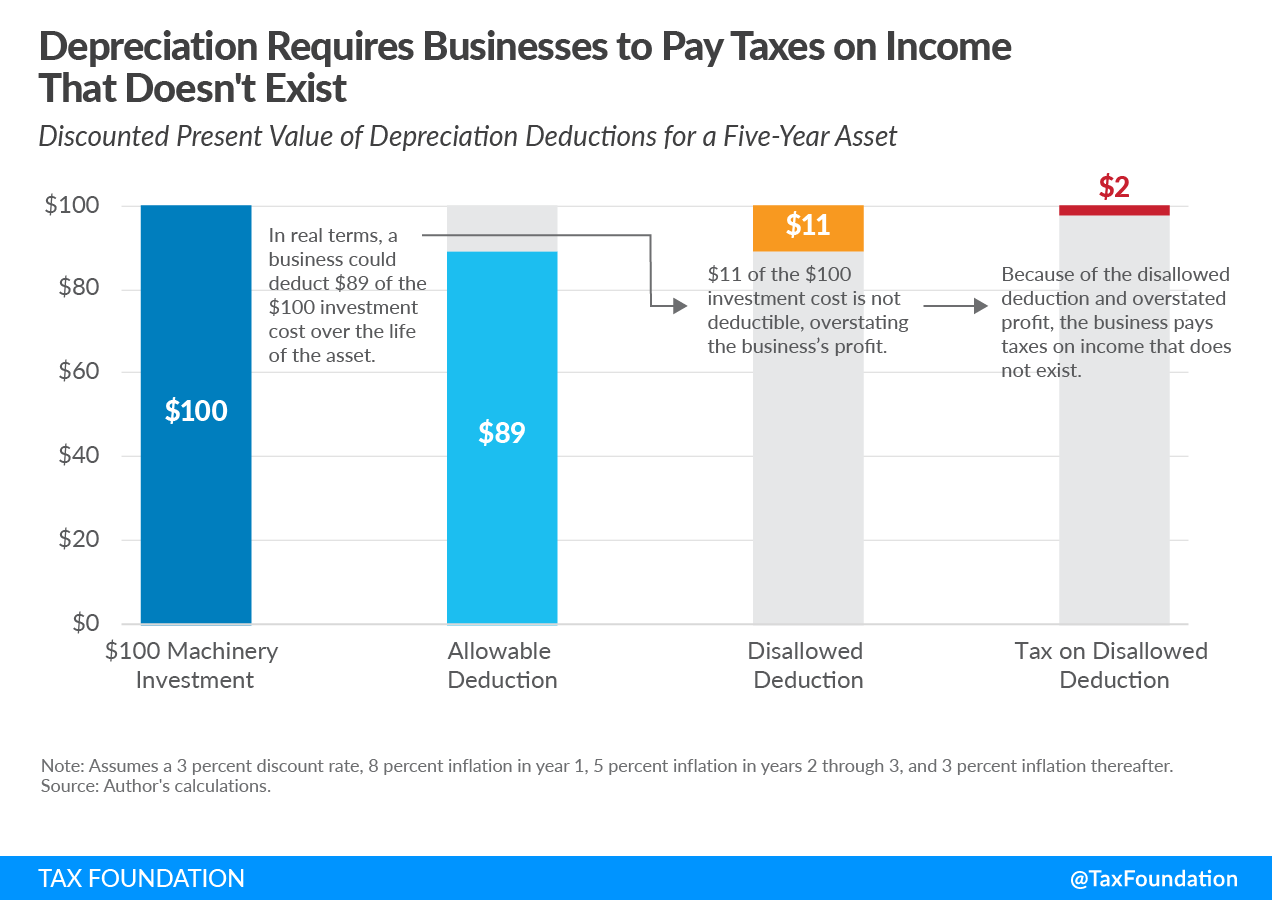

Bonus Depreciation Effects Details & Analysis Tax Foundation, The bill includes 100% bonus depreciation, allows for immediate research and development expensing and expands the child tax credit. The full house passed late wednesday by a 357 to 70 vote h.r.

Mclaren Gt3 2025 The livery for united autosports' pair of fia world endurance championship lmgt3 […]